pay utah state property taxes online

You can also pay online and. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file.

The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property.

. Historic Overview of Utahs Property Tax PDF File Property taxes are the main source of local funding and consist of the following. You can conveniently pay your real property taxes personal property taxes and mobile home taxes online. Do not staple your check to your return.

Your property serial number Look up Serial Number. If you do not have these please request a duplicate tax notice here. For security reasons our e-services.

If you owe Utah state taxes the following instructions will guide you through the process of making an online payment. Payments must be postmarked by. To find out the amount of all taxes and fees for your.

MOTOR VEHICLE TAXES FEES. They conduct audits of personal. Pay over the phone by calling 801-980-3620 Option 1 for real property.

Online payments may include a service fee. Filing Paying Your Taxes. What you need to pay online.

1 of the payment amount with a minimum fee of 100. Write your daytime phone number and 2021 TC-40 on your check. Form of Payment Payment Types Accepted Online.

If you are mailing a check or money order please write in your account number and filing period or use a. Motor Vehicle Taxes Fees. Tobacco Cigarette Taxes.

Ad Pay Your Taxes Bill Online with doxo. You will need your property serial number s. File pay manage your Utah taxes online.

Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah. To pay Real Property Taxes. CIGARETTE TOBACCO TAXES.

BUSINESS CORPORATE TAXES. Local property taxes that are used for general fund. Property Tax payments may be sent via the US Postal Service to the Treasurers Office.

For your protection do not send cash through the mail. Remove any check stub before sending. Steps to Pay Your Property Tax.

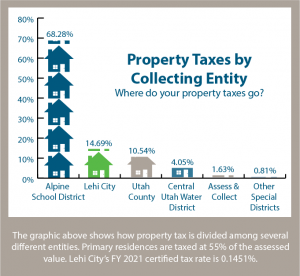

Property taxes in Utah are managed through the collaborative effort of several elected county offices. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. Click the link above to be directed to TAP Utahs Taxpayer Access Point DO NOT LOGIN OR CREATE A LOGIN Go to Payments and select either Make e-Check Payment or Make Credit Card Payment.

Please contact us at 801-297-2200 or taxmasterutahgov for more information. SALES USE TAXES. Payment Types Accepted Online.

Note regarding online filing and paying. This web site allows you to pay your Utah County Personal Property Taxes online using credit cards debit cards or electronic checks. We have arranged with Instant Payments to offer this service to you.

Do not mail cash with your return. The Recorders Office and the Surveyors Office records the boundaries and ownership. 0 Electronic check payment.

Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800.

Property Taxes When To Consider An Appeal Choose Park City Luxury Real Estate Agents

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

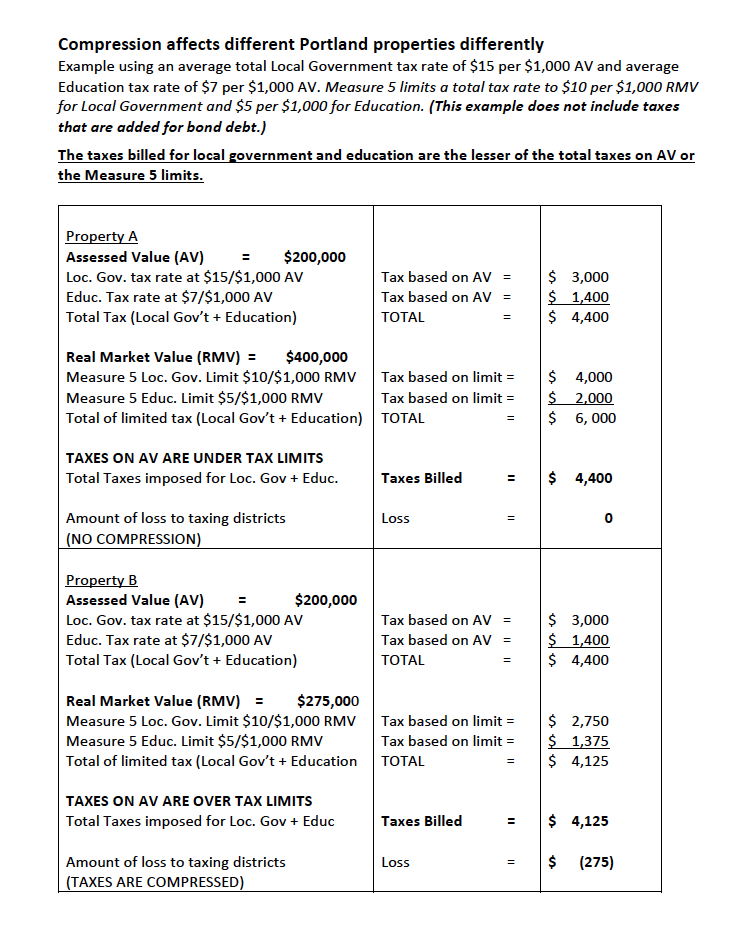

Property Taxes Compression Ballot Measures League Of Women Voters Of Portland

Riverside County Ca Property Tax Calculator Smartasset

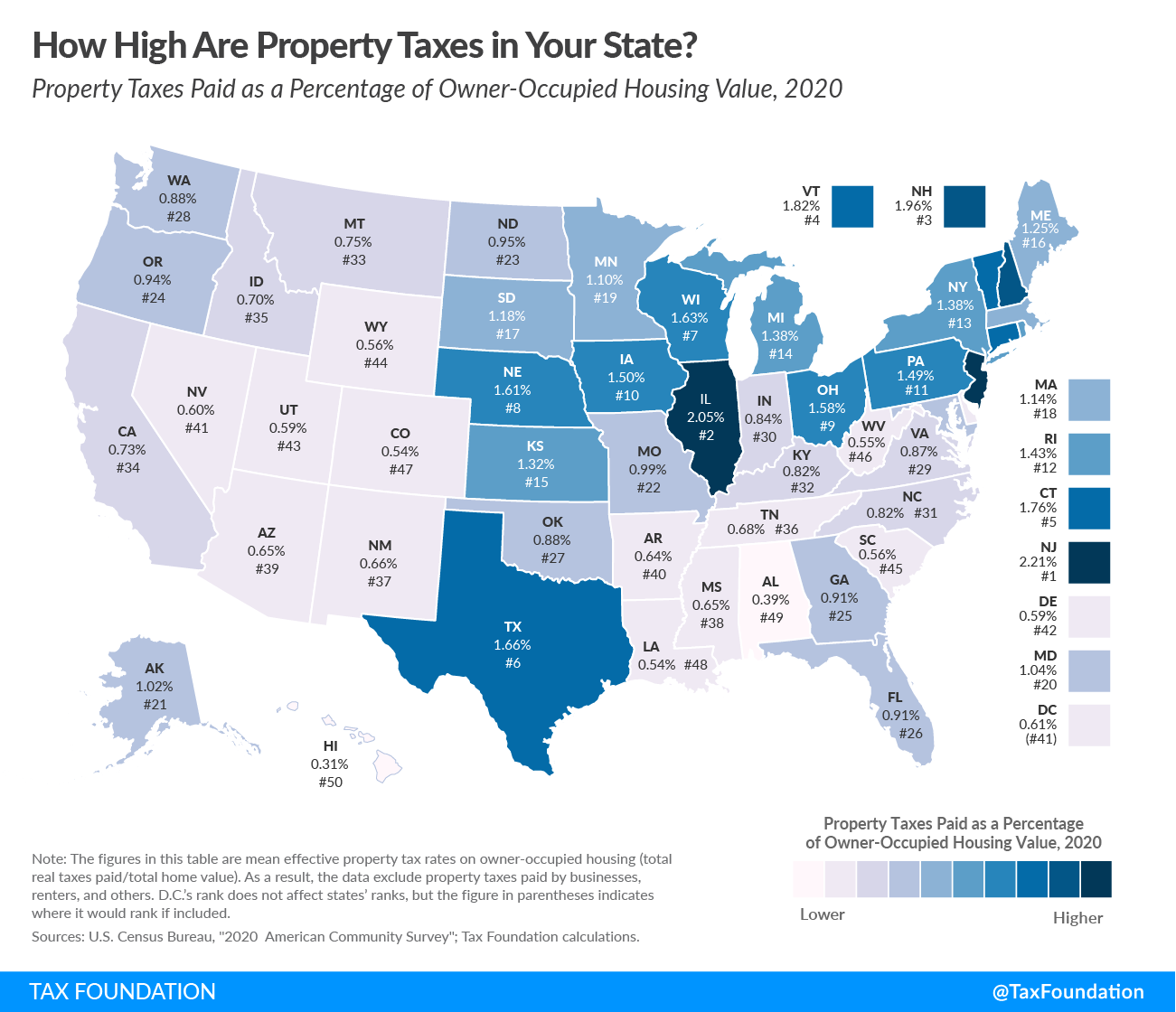

Property Taxes How Much Are They In Different States Across The Us

Property Tax How To Calculate Local Considerations

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

2022 Property Taxes By State Report Propertyshark

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota Retirement Advice

Utah Property Taxes Utah State Tax Commission

Property Taxes Department Of Tax And Collections County Of Santa Clara

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Property Tax By State Ranking The Lowest To Highest

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans